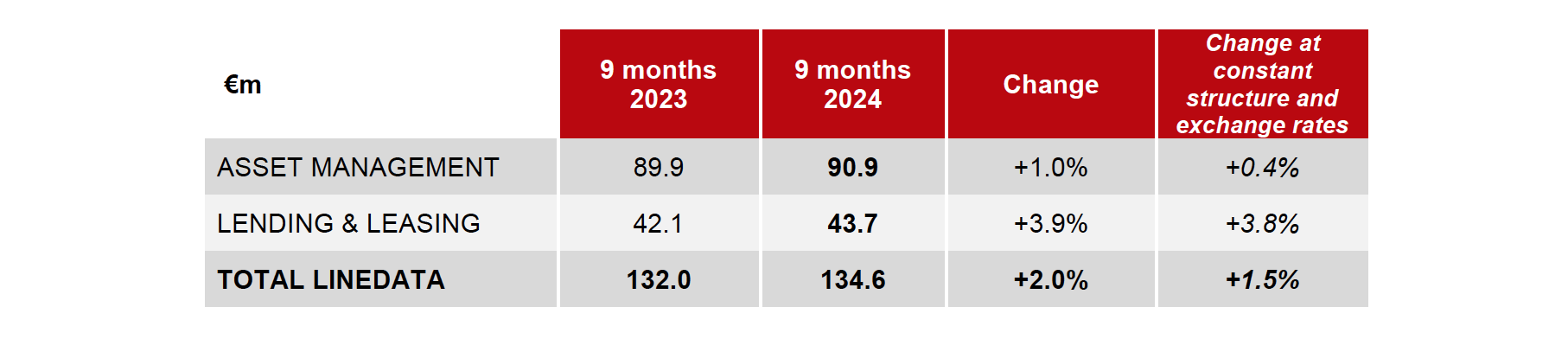

Neuilly-sur-Seine, October 23rd, 2024 – Linedata (Euronext Paris: LIN), the global solutions and outsourcing services provider to the investment management and credit finance industries, generated revenue of €134.6m over the first nine months of 2024, up 2.0% compared with the same period in 2023. At constant exchange rates, organic growth came to 1.5%.

At the end of September 2024, the recurring portion of revenue was stable, amounting to 77% of the total, i.e. €103.4m, up €1.7m compared with the same period in 2023.

Order intake in Q3 2024 was slightly down, at €14.9m, compared to €15.7m for the same period last year. Over the first nine months of 2024, bookings reached €57.0m, a 13.4% increase driven by the solid momentum in the Lending & Leasing segment.

Performance by segment:

ASSET MANAGEMENT (Q1: €29.2m, +0.4%; Q2: €30.4m, -0.4%; Q3: €31.4m, +3.2%)

The Asset Management segment performed well in Q3 2024, with a revenue increase of 3.2%, notably benefitting from proceeds transferring rights of use to a customer for a Back Office application. During the year's first nine months, growth reached 1.0% (+0.4% at constant structure and exchange rates).

The software division's revenue amounted to €68.3m over the first nine months of 2024, up 4.4% from the same period last year.

Revenue for the Services division came to €22.6m, down 7.9% at the end of September 2024. This decline was mainly due to the consulting business, which is more volatile by definition, while revenue posted by the Middle Office activity was almost stable over the period.

LENDING & LEASING (Q1: €14.7m, +9.7%; Q2: €15.5m, +6.5%; Q3: €13.5m, -4.4%)

Q3 2024 revenue for the Lending & Leasing segment was €13.5m, declining 4.4% following two quarters of steady growth. Revenue in the first nine months of the year totalled €43.7m, up 3.9%. On a like-for-like basis, the increase was 3.8%.

At the end of September 2024, commercial activity for the Lending & Leasing segment sustained its momentum with a total order intake of €28.2m, an increase of €10.8m compared to the same period last year - driven in part by the signing of a special contract.

Outlook:

For the full year 2024, the Group expects organic growth similar to that reported since the start of the financial year.

Next communication: Full-year 2024 revenue on January 30th, 2025, after trading.

ABOUT LINEDATA

With 25 years of experience and 700+ clients in 50 countries, Linedata’s 1200 employees in 20 offices provide global humanized technology solutions and services for the asset management and credit industries, helping its clients evolve and operate at the highest levels.

Headquartered in France, Linedata achieved revenues of EUR 183.3 million in 2023 and is listed on Euronext Paris compartment B FR0004156297-LIN – Reuters LDSV.PA – Bloomberg LIN:FP