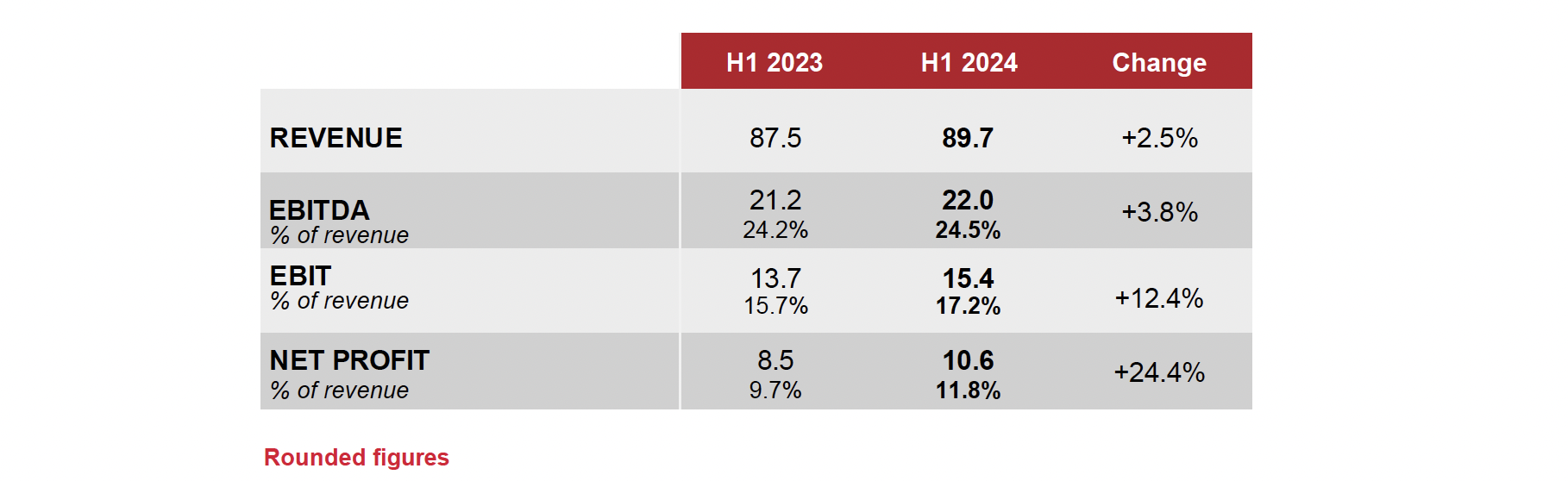

Revenue: €89.7m (+2.5%)

Net profit: €10.6m (11.8% of revenue)

Neuilly-sur-Seine, September 11th, 2024 – Linedata (LIN:FP), the global solutions and outsourcing services provider to the investment management and credit finance industries, announces an improvement in its first-half 2024 results, driven by revenue growth and operating efficiency.

Linedata generated revenue of €89.7m in the first half of 2024, an increase of 2.5% in reported terms. On a constant structure and exchange rate basis, growth stood at 2.1%.

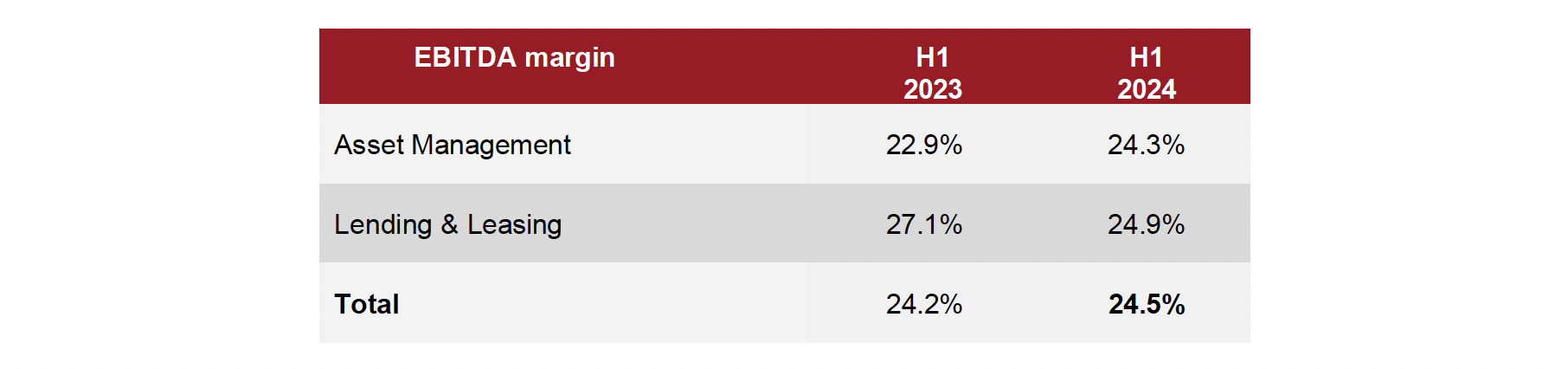

The strong growth in the Lending & Leasing business and the improved margin in the Asset Management segment contributed to the solid momentum in the Group’s performance indicators.

Analysis of results

In H1 2024, Linedata achieved an EBITDA of €22.0m (24.5% of revenue), representing a €0.8m increase compared to the same period of the previous financial year.

“Payroll costs,” Linedata’s main operating cost item, increased by 6.0% to €46.3m. This growth reflects one-off restructuring costs, a decrease in capitalized R&D expenses, and the reclassification of social security contributions totalling €0.5m, which were previously booked under “Taxes and duties”. Restated for these items, the increase in employee expenses aligns with the business growth.

The “Purchases and external costs” item decreased by 4.3% to €19.1m, benefiting from an improved business mix for the Asset Management Software division in the US.

Net amortization and provisions declined €0.9m to €6.5m thanks to a decrease in amortization linked to capitalized R&D from previous financial years and the reversal of provisions for risks. As a result, operational income reached €15.4m, representing a year-on-year improvement of 12.4% compared with H1 2023.

The financial result amounted to -€1.4m, compared to €-1.6m for the previous financial year. This change can mainly be attributed to a reduction in average debt.

After booking a tax burden of €3.5m, net profit significantly increased by 24.4% to €10.6m, resulting in a strong net margin of 11.8% (up by 2.1 pts year-on-year vs. H1 2023).

Balance sheet analysis

The equity is stable at €120.4m on June, 30th 2024 compared to €113m on December 31st, 2023. This change mainly reflects the profit for the first half of the year.

Net debt (*) totalled €52.6m, representing approximately 1.0x consolidated EBITDA on a rolling 12-month period and excluding the impact of IFRS 16 (1.5x on December 31st 2023). This demonstrates the Group’s ability to quickly reduce its debt, excluding external growth and capital transactions.

Outlook

Linedata expects continued organic revenue growth and solid operating profitability in the second half of 2024.

Next communication: Q3 2024 revenue on October 23rd, 2024, after trading.

*excluding IFRS 16 lease liabilities but including the property lease portfolio

ABOUT LINEDATA

With 25 years’ experience and 700+ clients in 50 countries, Linedata’s 1200 employees in 20 offices provide global humanized technology solutions and services for the asset management and credit industries that help its clients to evolve and to operate at the highest levels.

Headquartered in France, Linedata achieved revenues of EUR 183.3 million in 2023 and is listed on Euronext Paris compartment B FR0004156297-LIN – Reuters LDSV.PA – Bloomberg LIN:FP