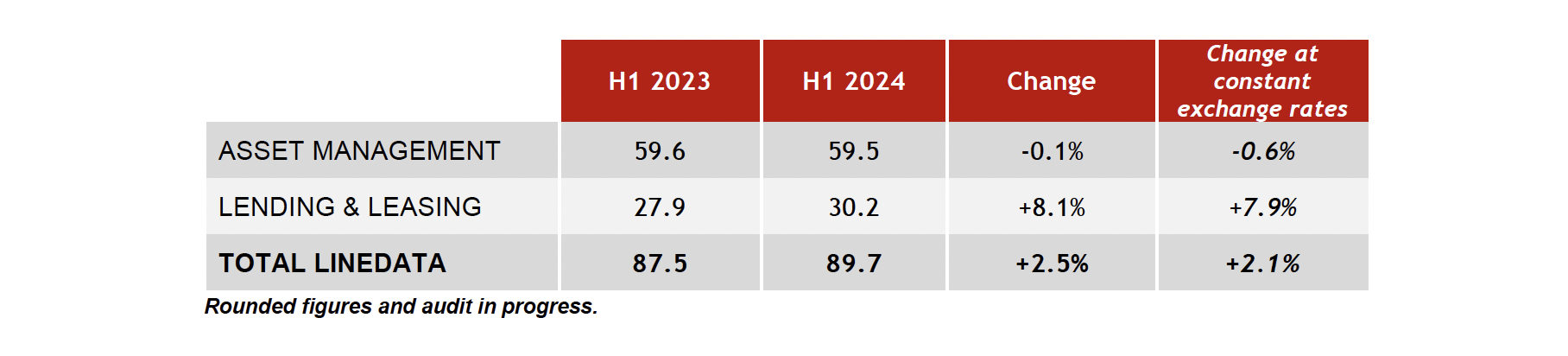

Neuilly-sur-Seine, 23 July 2024 – Linedata (Euronext Paris: LIN), the global solutions and outsourcing services provider to the investment management and credit finance industries, generated revenue of €89.7m in the first half of 2024, up 2.5% versus H1 2023. On a constant structure and exchange rate basis, organic growth stood at 2.1%.

The recurring share of revenue for the first half of 2024, at €70.8m, is up €2.5m (or +4.1%) and represents 79% of the total compared to 78% for the same period of 2023.

Since the start of the year, order intake has been up strongly (+22.6%) and has come to €42.1m.

Performance by segment:

ASSET MANAGEMENT (Q1: €29.2m, +0.4%; Q2: €30.3m -0.5%)

The Asset Management segment was stable over the first six months of 2024. Revenue amounted to €59.5m (-0.1%) with contrasting trends between the Software & Services divisions

Revenue generated by the Software division reached €44.2m in H1 2024, up 2.0%. Growth was mainly driven by migration programs for installed base on the AMP platform with an increase of €1.0m over the period for the Front Office business. As previously announced, upgrades on new AMP applications entered an acceleration phase notably with the biggest customers.

Revenue at the Services division came to €15.3m in H1 2024, reflecting a temporary contraction of 5.7%, mainly owing to delays in signing new contracts in the consulting activity. The “Middle Office” activity remained positive and promising.

LENDING & LEASING (Q1: €14.7m, +9.7%; Q2: €15.5m +6.5%)

The Lending & Leasing segment, at €30.2m, held up well, with steady growth of 8.1%, which benefited all the Group’s geographic regions. Recurring revenue continued to increase to reach 82% for this segment. Commercial activity was particularly dynamic with bookings of €21.9m (+€11.5m vs. H1 2023)

Appointment of a new Administrative and Financial Director

Linedata announced the appointment of Mr Sebastien Chavigny as Group CFO. Sébastien began his career at Arthur Andersen/Ernst & Young audit firms before joining the French oil and gas group Geoservices as Group Treasurer. After the acquisition of the latter by Schlumberger in 2010, he occupied various International Financial Director positions. In 2015, he joined Quadient (formerly Neopost) as Director of Financial Control, then, in 2020, Paragon-ID where he held the position of Group CFO until he was appointed at Linedata.

Outlook

Linedata expects operating profitability for the first half of 2024 to be close to that reported for the same period last year.

Next communication: H1 2024 results, 12 September 2024, after trading.

ABOUT LINEDATA

With 25 years’ experience and 700+ clients in 50 countries, Linedata’s 1200 employees in 20 offices provide global humanized technology solutions and services for the asset management and credit industries that help its clients to evolve and to operate at the highest levels.

Headquartered in France, Linedata achieved revenues of EUR 183.3 million in 2023 and is listed on Euronext Paris compartment B FR0004156297-LIN – Reuters LDSV.PA – Bloomberg LIN:FP