Neuilly-sur-Seine, 12 September 2022 – Linedata (Euronext Paris: LIN), the global solutions and outsourcing services provider to the investment management and credit finance industries, released its first-half 2022 results, in line with expectations.

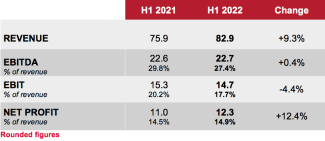

Linedata generated first-half revenue of €82.9m, up 9.3% on a reported basis (+3.7% in organic terms). This performance was driven by the strength of the Services business and continued steady client migrations to new platforms (notably AMP and EKIP360).

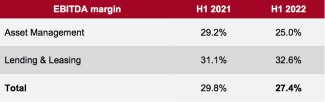

During the first half, the Group continued its R&D investments in its solutions and returned to normal business in terms of travel and professional trade gatherings. It also recruited new talent to strengthen its sales and marketing teams. As a result, the EBITDA margin for the first half contracted (-2.4 pts). This reflects, however, a return to a more normative level compared to the previous year, which was not typical of a normal level of business activity.

Analysis of results

Group EBITDA was almost flat (+0.4%) at €22.7m. Payroll costs increased by 12.2% to €40.1m. This reflects new recruitments over the period but also an overall increase in employee costs due to a 2022 policy of increasing compensation, to increase the attractiveness of Linedata in a very competitive labour market. The “Purchases and external costs” item increased by 22.9% to €18.6m. This increase can be attributed to the end of the freeze on travel and participation in professional trade shows and, also, to a significant use of outsourcing to support the strong increase in the Services business.

EBIT was €14.7m, down 4.4% compared with H1 2021. It reflects an increase in allocations to amortisation linked to capitalised R&D relative to the new platforms (in particular Linedata AMP and Linedata EKIP360).

The financial result was €1.8m versus €0.9m a year earlier. This improvement can be attributed notably to forex gains but also to a lasting decline in the cost of debt following the the replacement in 2021 of a redeemed bond debt by a new syndicated loan offering better financial terms.

After taxes of €4.1m, net profit was €12.3m, up 12.4%, bringing the net margin to 14.9% (+0.4 pts vs. H1 2021).

Balance sheet analysis

Shareholders’ equity stood at €146.6m at end-June 2022 versus €145.8m at end-December 2021. This notably includes the integration of net profit from the first half and restatements following the acquisition of company shares during the period in the amount of €9.3m

Net debt (*) was down €7.1m to €36.1m, representing 0.8 times consolidated EBITDA on a 12-month moving average excluding IFRS 16.

Appointment

Linedata has announced the appointment of Mrs Dounia El Hasnaoui to the position of Group CFO, to replace Mr Arnaud Allmang, who is moving to a different position within the Group’s Management Team. After first gaining experience at an auditing firm, Dounia spent 12 years with a major digital services company, notably in the finance department working with operating entities.

Outlook

During the second half of the year, Linedata will step up its commercial efforts and continue with migration projects for its installed base with a view to confirming the return to organic growth seen in H1 2022.

Next communication: Q3 2022 revenue on 20 October 2022 after trading.

*excluding IFRS 16 lease liabilities but including the property lease portfolio