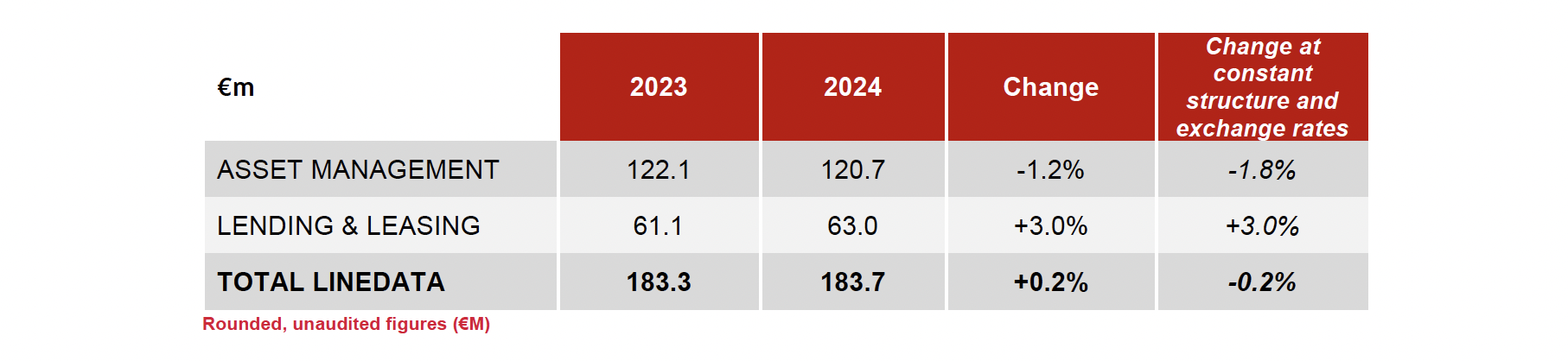

Neuilly-sur-Seine, January 30th, 2025 – Linedata (LIN:FP) reported full-year 2024 revenue of €183.7m, stable compared with the same period in 2023. It includes a 3.0% increase for the Lending & Leasing segment, with a 1.2% decline in Asset Management activities.

Recurring revenue for the fiscal year was €137.5m, i.e. 75% of total revenue, representing a performance that was comparable with the previous fiscal year in value and percentage terms.

Bookings for 2024 reached €78.9m, up 4.4%. Despite the 13.7% decline posted in Q4 2024, commercial activity performed well over the last three years, averaging annual growth of around 10% across all segments.

Performance by segment:

ASSET MANAGEMENT (Q1: €29.2m, +0.4%; Q2: €30.4m, -0.4%; Q3: €31.4m, +3.4%; Q4: €29.8m, -7.5%)

Revenue generated in the Asset Management segment amounted to €120.7m, representing negative organic growth of 1.8%, entirely due to the Services division. Commercial activity declined temporarily, with full-year bookings down 12.0% at €37.8m.

The Software division’s revenue totaled €90.4m, up by 1.4% on a reported basis and 0.5% at constant exchange rates. The activity benefited from the resilience of Funds Services applications, the growth delivered through the launch of the new AMP platform and the transfer of rights of use to a client for Back Office software.

Revenue for the Services division came to €30.3m, down 8.0% on a reported and organic basis. As stated above, the negative organic growth was mainly due to advisory and support activities, which are less recurrent. Co-sourcing income for 2024 remained strong at €16.5m, accounting for 54% of the total.

LENDING & LEASING (Q1: €14.7m, +9.7%; Q2: €15.5m, +6.5%; Q3: €13.5m, -4.4%; Q4: €19.3m, +1.1%)

Revenue for the Lending & Leasing segment amounted to €63.0m in 2024, up 3.0% in reported terms and at constant structure and exchange rates. Growth in the business was supported by an increase in recurring revenue, with its portion rising from 67% in 2023 to 74% in 2024.

Full-year bookings came in at €41.1m versus €32.6m a year earlier, representing a sustained increase of 26.0%.

Outlook

Linedata expects operating profitability for 2024 to be close to that of the previous fiscal year.

Next communication: Full-year 2024 results on February 13th, 2025, after trading.

ABOUT LINEDATA

With 25 years of experience and 700+ clients in 50 countries, Linedata’s 1,200 employees in 20 offices provide global humanized technology solutions and services for the asset management and credit industries, helping its clients evolve and operate at the highest levels. Headquartered in France, Linedata achieved revenues of EUR 183.7 million in 2024 and is listed on Euronext Paris compartment B FR0004156297-LIN – Reuters LDSV.PA – Bloomberg LIN:FP