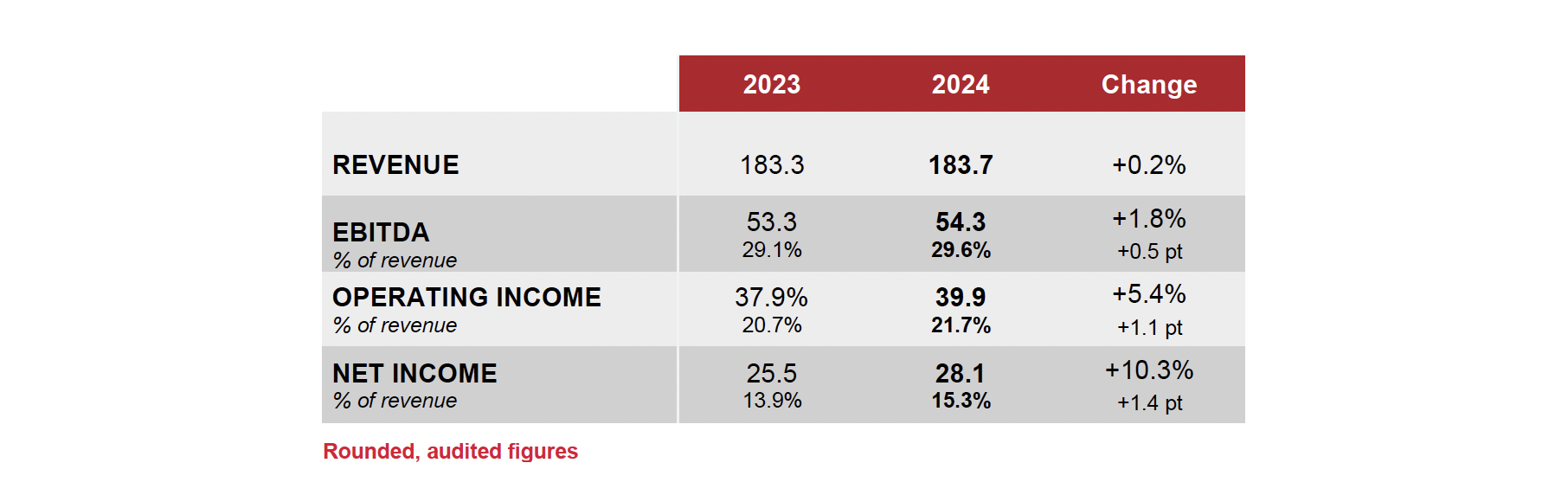

Revenue: €183.7m (+0.2%)

EBITDA margin: 29.6% of revenue

Neuilly-sur-Seine, February 13, 2025 – The Board of Directors of Linedata (LIN:FP), the global solutions and outsourcing services provider to the investment management and credit finance industries, closed the 2024 financial statements on February 11, 2025, which show an upturn.

Group revenue was stable in 2024, at €183.7m, after three years of growth, averaging around 4.5%.

Benefitting from a highly recurring business model and a product mix with a higher share of Software revenue, Linedata posted an EBITDA margin of 29.6% in 2024, up slightly from 2023.

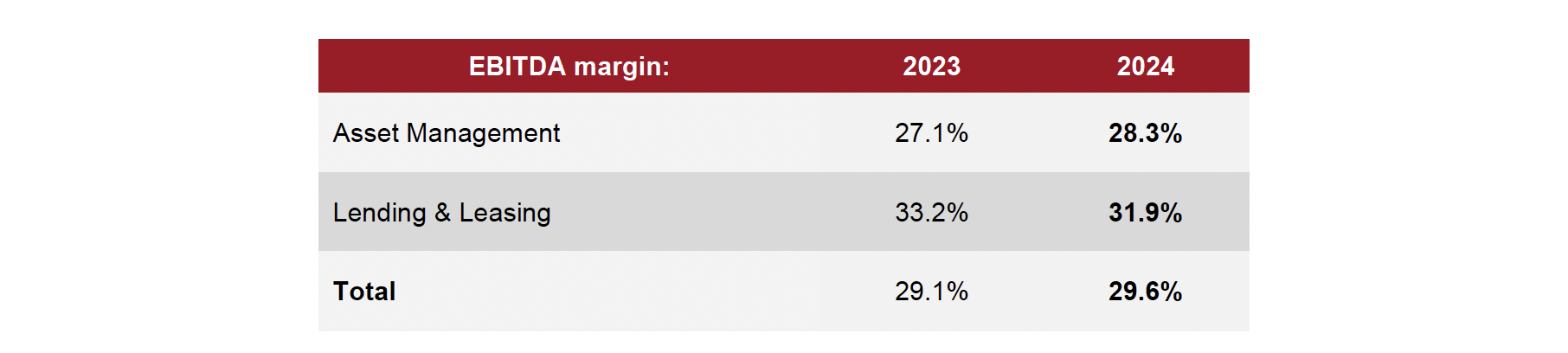

Asset Management

Revenue generated by the Asset Management segment amounted to €120.7m, down 1.2%, which can entirely be attributed to the Services division. EBITDA margin increased by 1.2 points to 28.3%, driven by a more favorable revenue mix and the transfer to a client of back-office software user rights.

Lending & Leasing

Revenue for the Lending & Leasing segment amounted to €63.0m in 2024, up 3.0%. The continued improvement in business activity over the past several years demonstrates the success of the front-to-back platforms developed by Linedata and sold to renowned players around the world. EBITDA reached €20.1m, delivering a strong 31.9% margin.

Results analysis

Group EBITDA totaled €54.3m, up 1.8%. Employee expenses, the main source of Linedata’s operational costs, rose 2.5% to €87.3m. The increase reflects the growth in the average headcount over the period and the impact of salary increases, as well as one-off reorganization costs and a decline in capitalized R&D expenses. The increase in employee expenses was more than offset by the decrease in subcontracting after the contraction in the revenue of the Asset Management Services division.

Overall, EBITDA margin amounted to 29.6% of revenue, a 0.5-point increase compared with the previous fiscal year.

Operating income, at €39.9m, increased strongly, by 5.4%, owing largely to a reduction in amortization relative to capitalized R&D and the reversal of provisions.

Financial income came out at -€2.4m, compared with -€4.3m in the 2023 fiscal year, for a difference of +€1.9m. The improvement of this indicator can be attributed to a +€0.4m decline in the cost of net financial debt and to a +€1.2m net foreign exchange gains relating to the appreciation of the main currencies used by the Group.

Including a tax expense of €9.4m, net income improved by 10.3% to €28.1m, for a net margin of 15.3%.

Net earnings per share reached €5.69 in 2024, compared with €5.14 in 2023.

Balance sheet analysis

On December 31, 2024, equity stood at €138.4m, compared with €113.0m on December 31, 2023.

Cash available as of December 31, 2024 amounted to €38.5m. Net debt (*) reached €50.5m, reflecting a leverage ratio of 0.99x 2024 EBITDA (**), against 1.50x at December 31, 2023, illustrating the Group’s continued rapid debt reduction.

Dividend

A dividend of €1.75 per share will be proposed at the next Annual General Meeting.

Outlook

Linedata expects the Asset Management Services division to return to growth in 2025, contributing favorably to consolidated revenue.

Next communication: Q1 2025 revenue, April 24, 2025, after trading.

(*) Excluding IFRS 16 lease liabilities but including the property lease portfolio.

(**) According to the definition specified in the senior debt contract.

ABOUT LINEDATA

With 26 years of experience and 700+ clients in 50 countries, Linedata’s 1,200 employees in 20 offices provide global humanized technology solutions and services for the asset management and credit industries, helping its clients evolve and operate at the highest levels. Headquartered in France, Linedata achieved revenues of EUR 183.7 million in 2024 and is listed on Euronext Paris compartment B FR0004156297-LIN – Reuters LDSV.PA – Bloomberg LIN:FP